To run this code in parallel, we will use IPython’s LoadBalancedView class, which distributes work to the engines using dynamic load balancing. This view is a wrapper of the Client class shown in the previous example. The parallel calculation using LoadBalancedView can be found in the file mcpricer.py. The code in this file creates a LoadBalancedView instance and then submits a set of tasks using LoadBalancedView.apply() that calculate the option prices for different volatilities and strike prices. The results are then plotted as a 2D contour plot using Matplotlib.

#!/usr/bin/env python

"""Run a Monte-Carlo options pricer in parallel."""

#-----------------------------------------------------------------------------

# Imports

#-----------------------------------------------------------------------------

import sys

import time

from IPython.parallel import Client

import numpy as np

from mcpricer import price_options

from matplotlib import pyplot as plt

#-----------------------------------------------------------------------------

# Setup parameters for the run

#-----------------------------------------------------------------------------

def ask_question(text, the_type, default):

s = '%s [%r]: ' % (text, the_type(default))

result = raw_input(s)

if result:

return the_type(result)

else:

return the_type(default)

cluster_profile = ask_question("Cluster profile", str, "default")

price = ask_question("Initial price", float, 100.0)

rate = ask_question("Interest rate", float, 0.05)

days = ask_question("Days to expiration", int, 260)

paths = ask_question("Number of MC paths", int, 10000)

n_strikes = ask_question("Number of strike values", int, 5)

min_strike = ask_question("Min strike price", float, 90.0)

max_strike = ask_question("Max strike price", float, 110.0)

n_sigmas = ask_question("Number of volatility values", int, 5)

min_sigma = ask_question("Min volatility", float, 0.1)

max_sigma = ask_question("Max volatility", float, 0.4)

strike_vals = np.linspace(min_strike, max_strike, n_strikes)

sigma_vals = np.linspace(min_sigma, max_sigma, n_sigmas)

#-----------------------------------------------------------------------------

# Setup for parallel calculation

#-----------------------------------------------------------------------------

# The Client is used to setup the calculation and works with all

# engines.

c = Client(profile=cluster_profile)

# A LoadBalancedView is an interface to the engines that provides dynamic load

# balancing at the expense of not knowing which engine will execute the code.

view = c.load_balanced_view()

# Initialize the common code on the engines. This Python module has the

# price_options function that prices the options.

#-----------------------------------------------------------------------------

# Perform parallel calculation

#-----------------------------------------------------------------------------

print "Running parallel calculation over strike prices and volatilities..."

print "Strike prices: ", strike_vals

print "Volatilities: ", sigma_vals

sys.stdout.flush()

# Submit tasks to the TaskClient for each (strike, sigma) pair as a MapTask.

t1 = time.time()

async_results = []

for strike in strike_vals:

for sigma in sigma_vals:

ar = view.apply_async(price_options, price, strike, sigma, rate, days, paths)

async_results.append(ar)

print "Submitted tasks: ", len(async_results)

sys.stdout.flush()

# Block until all tasks are completed.

c.wait(async_results)

t2 = time.time()

t = t2-t1

print "Parallel calculation completed, time = %s s" % t

print "Collecting results..."

# Get the results using TaskClient.get_task_result.

results = [ar.get() for ar in async_results]

# Assemble the result into a structured NumPy array.

prices = np.empty(n_strikes*n_sigmas,

dtype=[('ecall',float),('eput',float),('acall',float),('aput',float)]

)

for i, price in enumerate(results):

prices[i] = tuple(price)

prices.shape = (n_strikes, n_sigmas)

strike_mesh, sigma_mesh = np.meshgrid(strike_vals, sigma_vals)

print "Results are available: strike_mesh, sigma_mesh, prices"

print "To plot results type 'plot_options(sigma_mesh, strike_mesh, prices)'"

#-----------------------------------------------------------------------------

# Utilities

#-----------------------------------------------------------------------------

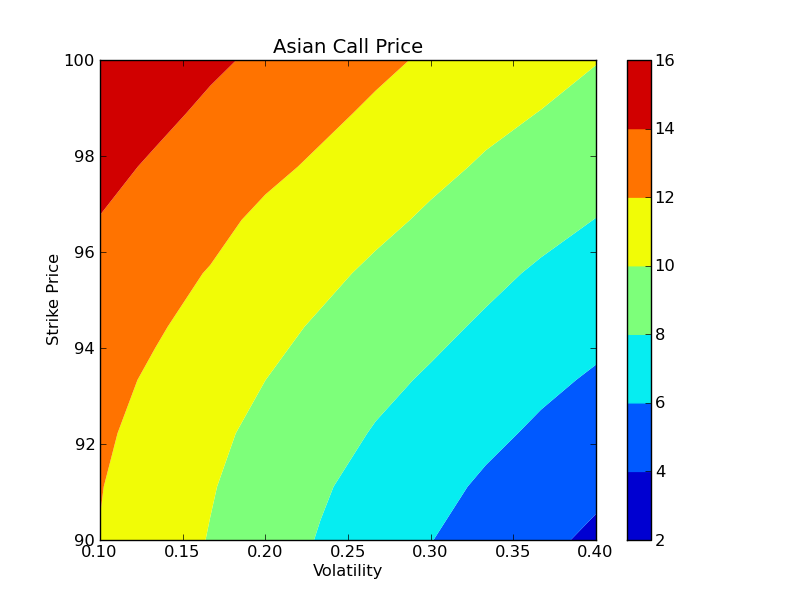

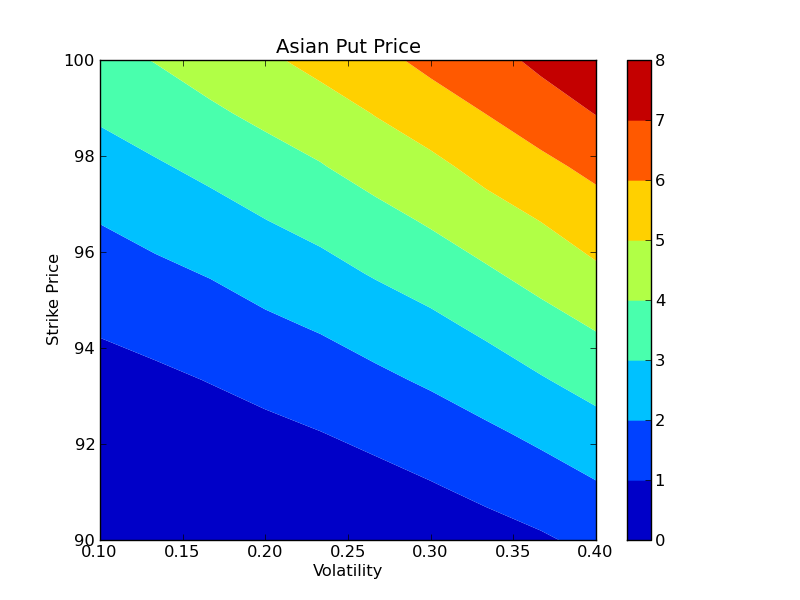

def plot_options(sigma_mesh, strike_mesh, prices):

"""

Make a contour plot of the option price in (sigma, strike) space.

"""

plt.figure(1)

plt.subplot(221)

plt.contourf(sigma_mesh, strike_mesh, prices['ecall'])

plt.axis('tight')

plt.colorbar()

plt.title('European Call')

plt.ylabel("Strike Price")

plt.subplot(222)

plt.contourf(sigma_mesh, strike_mesh, prices['acall'])

plt.axis('tight')

plt.colorbar()

plt.title("Asian Call")

plt.subplot(223)

plt.contourf(sigma_mesh, strike_mesh, prices['eput'])

plt.axis('tight')

plt.colorbar()

plt.title("European Put")

plt.xlabel("Volatility")

plt.ylabel("Strike Price")

plt.subplot(224)

plt.contourf(sigma_mesh, strike_mesh, prices['aput'])

plt.axis('tight')

plt.colorbar()

plt.title("Asian Put")

plt.xlabel("Volatility")

if __name__ == '__main__':

plot_options(sigma_mesh, strike_mesh, prices)

plt.show()

To use this code, start an IPython cluster using ipcluster, open IPython in the pylab mode with the file mcdriver.py in your current working directory and then type:

In [7]: run mcdriver.py

Submitted tasks: [0, 1, 2, ...]

Once all the tasks have finished, the results can be plotted using the plot_options() function. Here we make contour plots of the Asian call and Asian put options as function of the volatility and strike price:

In [8]: plot_options(sigma_vals, K_vals, prices['acall'])

In [9]: plt.figure()

Out[9]: <matplotlib.figure.Figure object at 0x18c178d0>

In [10]: plot_options(sigma_vals, K_vals, prices['aput'])

These results are shown in the two figures below. On a 8 core cluster the entire calculation (10 strike prices, 10 volatilities, 100,000 paths for each) took 30 seconds in parallel, giving a speedup of 7.7x, which is comparable to the speedup observed in our previous example.